As a homeowner in Florida, you know that wind, rain and rising seas are part of life. In recent years, these risks have driven homeowners insurance premiums up and forced some companies to leave the state. By the start of 2025, lawmakers had already made sweeping reforms to try to control costs and to attract new insurers. Many of those efforts started in 2022 and 2023, and the effects are finally being felt. But the story didn’t end there. This past year brought its own set of laws, market changes and challenges. Our goal at Orange Contracting and Roofing is to help you understand what changed, what stayed the same and what it means for your roof and your wallet.

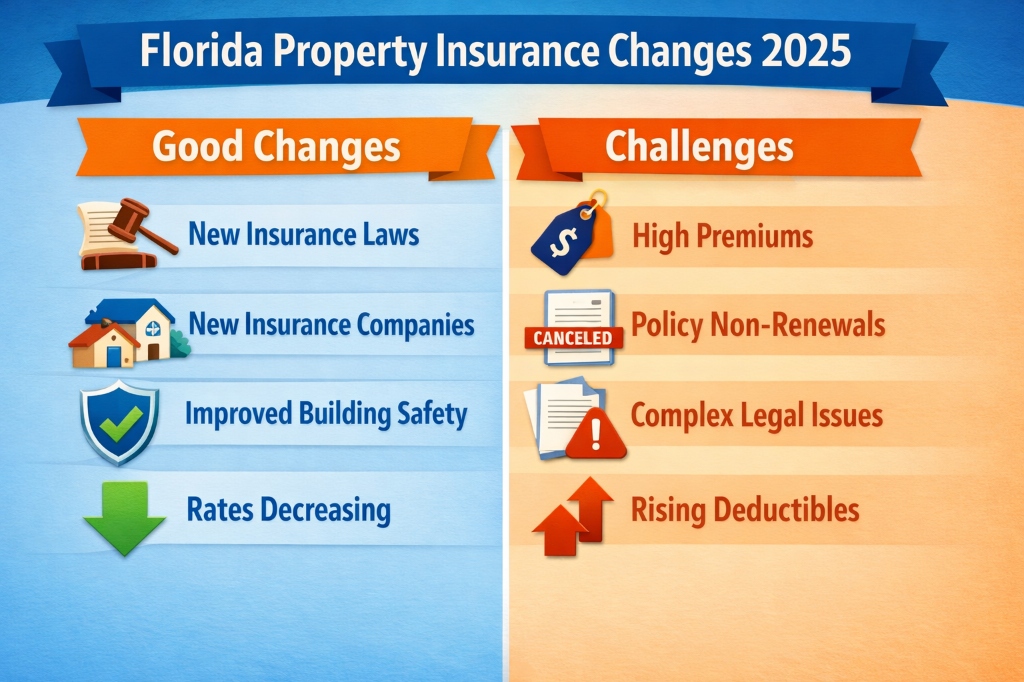

We’ve written this article at an eighth‑grade reading level so that it’s accessible to every homeowner. We’ll look at the good news, like small drops in premiums and new programs for strengthening your home, as well as the bad news, like higher deductibles and policy cancellations. We’ll also explain how simple upgrades to your roof or windows can save you money on insurance, and what to watch for as the market evolves.

Why Florida’s Property Insurance Matters to Homeowners

Florida is surrounded by water on three sides, so tropical storms are always a threat. When hurricanes strike, they damage roofs, windows and entire structures. After storms Ian and Idalia in 2023, insurers paid out billions of dollars for wind and water damage. Fraudulent claims and a flood of lawsuits made matters worse. By the end of 2023, the average homeowner’s premium in Florida had jumped above $3,700 per year. Some regions, like South Florida, were even higher. Many companies stopped writing new policies, which left the state‑backed Citizens Property Insurance as the only option for hundreds of thousands of homeowners.

In response, the legislature enacted a series of reforms in 2022 and 2023. Lawmakers eliminated assignment of benefits (contracts that let contractors sue insurers in your name) and one‑way attorney fees (rules that required insurers to pay a homeowner’s lawyer if the homeowner won in court). They shortened the deadline for filing claims from two years to one year, set up a state program to help insurers buy reinsurance, and put stricter limits on Citizens. Those reforms started to work. Lawsuits dropped, eleven new insurers filed to enter the market, and by early 2025 more than 400,000 policies moved from Citizens back into the private market. But the reforms also shifted more risk to policyholders. Today, homeowners must carefully follow deadlines, and they can’t automatically recover attorney fees even if they win a claim.

The Good News in 2025

Rates Begin to Flatten and Even Drop

After years of double‑digit increases, 2025 finally delivered a bit of relief. Between August and September 2025, the statewide average premium for owner‑occupied homes increased by just one dollar, from $3,747 to $3,748. That 0.03% bump is the smallest monthly change since the state began publishing monthly reports. Over the first nine months of the year, premiums rose only 1.5%. For 38 out of 88 insurers reporting data, the average cost of homeowner policies decreased in September, and seven remained flat. A quiet hurricane season and lower reinsurance costs played a big role.

Several companies even announced rate reductions. Security First Insurance cut rates on its Signature HO3 policy by 8% statewide, effective December 18, 2025. It had already reduced rates by 5.2% in 2024. The company also cut rates for condo and renters policies earlier in 2025 and offered discounts up to 20% for newly built homes. Other carriers like Florida Peninsula and Patriot Select filed for reductions of around 8–12%. According to state officials, insurers filed for 73 rate decreases and 94 zero‑percent increases since last year. This means millions of homeowners saw either a modest drop or no increase when they renewed their policies.

New Insurers and More Choices

With lawsuits falling and reforms kicking in, new companies have entered Florida’s market. Analysts estimate that between 11 and 14 new insurers were approved after 2023. These newcomers, such as Viceroy Preferred and Patriot Select, compete for customers by offering competitive rates, better service and modern digital tools. The Citizens depopulation program allows private companies to take over Citizens policies mid‑term, and these companies cannot raise your premium until the end of your contract. Patriot Select, for example, reduced the average premium on its takeout policies by over 11%.

Programs to Strengthen Your Home

One of the biggest pieces of good news is the expansion of state‑sponsored programs that help you harden your home. The My Safe Florida Home program, launched in 2007 and revived in recent years, provides free wind mitigation inspections and grants that pay for improvements such as impact‑resistant windows, doors and stronger roof attachments. In 2024 lawmakers expanded a pilot program for condos. HB 393, enacted in 2025, created the My Safe Florida Condo pilot program. Condo associations can now apply for matching grants to upgrade windows, doors and roof‑to‑wall connections. To participate, associations must complete a milestone inspection of the building’s structure, create a structural integrity reserve and get approval from 75% of unit owners. This helps ensure that older condo buildings along the coast are inspected and maintained before a storm does serious damage.

Better Roofing Rules

For homeowners who need a new roof, HB 715 expanded what licensed roofing contractors can do. Contractors may now evaluate and improve roof‑to‑wall connections (metal clips or straps that tie your roof rafters to the walls of your house) without requiring a separate general contractor license. Strong roof‑to‑wall connections are critical because wind forces can peel a roof off a house if it isn’t properly attached. The law also changes cancellation rules: homeowners now have more time to cancel a roofing contract signed during an emergency, and roofing contractors must provide clear notices about their license and your rights. For a company like Orange Contracting and Roofing, this means we can offer a one‑stop service to inspect, repair and strengthen your roof, which can translate into insurance discounts for you.

Clearer Flood Disclosures

Flooding is the largest cause of property losses in Florida, yet many homeowners and renters don’t realize that their standard policy does not cover flood damage. SB 948, passed in 2025, requires landlords and home sellers to disclose any past flood damage and whether the property is in a flood zone. Tenants can terminate leases if a landlord fails to tell them about flood risk and they later suffer flood damage. For buyers, the disclosure must be separate from other documents so it isn’t overlooked. This transparency helps consumers make informed decisions and encourages them to purchase flood insurance if needed.

Stricter Condo Association Oversight

Condos and cooperatives make up a large portion of coastal housing. HB 913 imposed new requirements on associations: they must purchase replacement‑value insurance for common property and update that coverage every three years, maintain detailed financial records online, fund reserves for structural repairs and ensure that board members complete education courses. Associations must also undergo periodic structural inspections and share the results with residents. These measures were sparked by tragic building collapses in recent years and are intended to protect unit owners from surprise assessments and expensive repairs. As a homeowner, you should ask your association about its reserve fund and inspection schedule.

Statutory Changes in 2025 at a Glance

Below is a quick reference of the major laws that took effect or were signed in 2025. We’ve kept the descriptions short to make them easy to read.

| Law | What It Does | Impact on Homeowners |

|---|---|---|

| SB 948 – Flood Disclosure | Requires landlords and sellers to inform tenants and buyers of past flood damage and flood zone status | You get a warning about flood risks and can cancel a lease if disclosures aren’t made |

| HB 393 – My Safe Florida Condo | Sets up a pilot program for condo associations to receive grants for wind mitigation; requires milestone inspections and structural reserves | Offers matching funds for window and roof upgrades; makes condo associations more accountable |

| HB 715 – Roofing Services | Allows licensed roofers to improve roof‑to‑wall connections; changes cancellation rules and notice requirements | Makes it easier to strengthen your roof and understand your contract |

| HB 913 – Condo & Co‑op Associations | Requires associations to carry replacement‑value insurance, post records online, fund repairs and conduct inspections | Improves building safety and transparency for condo owners |

| HB 1549 – Surplus Lines Insurance | Removes the requirement that agents must seek coverage from three admitted insurers before placing you with a surplus lines company; mandates a disclosure that surplus lines rates and forms are not regulated | Gives homeowners access to more insurers but requires caution because rates aren’t overseen by regulators |

| HB 655 – Pet Insurance (effective 2026) | Defines pet insurance as property insurance; sets standards for disclosures, waiting periods and consumer protections | If you insure a pet, you’ll have clearer rights and a 30‑day free‑look period; it does not affect home coverage |

The Other Side of the Story: Ongoing Challenges

While the news above is encouraging, Florida homeowners still face serious challenges. Here are some of the pain points that remained in 2025:

Premiums Are Still High

Even though rate increases have slowed, the average premium is 34% higher than it was right after the 2022 reforms. In other words, the market is stabilizing, but not cheap. Insurers continue to factor in construction inflation (higher costs for materials and labor) and the risk of future storms. Many policies now carry higher hurricane deductibles, sometimes 2% or 5% of your home’s insured value. For a $400,000 home, a 5% hurricane deductible means paying $20,000 out of pocket before insurance starts to pay.

Non‑Renewals and Cancellations

Some homeowners are still receiving non‑renewal notices. Insurers may cancel or refuse to renew a policy if your roof is too old, if you haven’t made required repairs or if your home is in a high‑risk flood zone. Proposed legislation in 2025 aimed to stop insurers from canceling policies on homes damaged by hurricanes until repairs are completed, but the bills did not pass. As of 2025, insurers can still cancel a policy after a major storm once repairs are done or at the next renewal. This uncertainty makes it essential to keep your home in good condition and to document repairs.

Complex Legal Proposals and Uncertainty

During the 2025 legislative session, several bills tried to roll back the 2022–2023 reforms. HB 1551 and its companion SB 426 proposed restoring “one‑way” or “prevailing party” attorney fees in property insurance lawsuits. SB 554 would have required strict claim processing rules, mandatory mediation and new fee schedules. Other bills sought to cap rate increases, change dispute resolution processes or mandate arbitration. None of these proposals passed, but they created uncertainty for both insurers and homeowners. If they return in 2026, they could raise costs again or alter how claims are handled.

Surplus Lines: More Choice, Less Oversight

HB 1549 made it easier for brokers to place homeowners with surplus lines insurers—companies that are not fully regulated by Florida. Before, agents had to show that at least three authorized insurers declined your risk before turning to surplus lines. That requirement is gone. These insurers can help people in high‑risk areas find coverage, but there is a trade‑off: their rates and policy language aren’t reviewed by state regulators. The law requires agents to disclose this and to get your acknowledgment, but you’ll need to read your policy carefully.

Flood Insurance Requirements for Citizens

Citizens policies are cheaper, but they come with strings attached. If your home is insured through Citizens and has a replacement value over $500,000 in 2025, you are required to purchase separate flood insurance, even if your house isn’t in a federal flood zone. This requirement will expand to homes over $400,000 in 2026 and to all Citizens policies by 2027. The cost of flood insurance can range from a few hundred to several thousand dollars per year depending on your elevation and location.

How to Protect Your Home and Save on Insurance

As a contracting and roofing company, we want to help you take practical steps to lower your risk and your premiums. Here are several actions you can take:

-

Get a Wind Mitigation Inspection: Florida law requires insurers to offer discounts for homes with certain wind‑resistant features. A licensed inspector will look at your roof shape, the way your roof deck is attached, the roof‑to‑wall connections, secondary water barriers and opening protection. Submitting the inspection report to your insurer can qualify you for substantial discounts.

-

Strengthen Roof‑to‑Wall Connections: Adding metal straps or clips that tie roof rafters to wall studs can increase your home’s wind resistance. Under HB 715, roofing contractors like us can perform this work during a re‑roof without needing a separate license. Reinforcing your roof in this way often unlocks one of the largest available discounts.

-

Install Impact‑Resistant Windows and Doors: These products are tested to withstand flying debris. Many insurers offer credits for impact windows, doors and storm shutters because they reduce the chance of a breach during a hurricane. In some counties, local codes already require them for new construction.

-

Upgrade Your Garage Door: A weak garage door can collapse under wind pressure and allow the roof to lift off. Installing a reinforced door with heavy hinges and bracing is an inexpensive way to improve your home’s resilience.

-

Keep Your Roof in Good Shape: Clean gutters, remove debris and replace missing shingles promptly. Many insurers will not renew if your roof is over 15 years old. Investing in a new roof may qualify you for a discount, especially if you choose a hip roof design that has slopes on all four sides.

-

Take Advantage of Grants and Programs: The My Safe Florida Home and My Safe Florida Condo programs may cover a portion of your costs for wind mitigation improvements. Funding is limited, so apply early when applications open.

-

Review Your Policy Every Year: Make sure you understand your coverage limits, deductibles and exclusions. Ask your agent about new companies offering better rates. If you’re placed with a surplus lines carrier, read the disclosure carefully and consider whether the coverage fits your needs.

-

Purchase Flood Insurance: Even if you’re not required to, a separate flood policy protects against rising water – something a standard policy does not cover. Flood insurance is often more affordable than homeowners assume and may be required if you refinance or sell your home.

Looking Ahead

2025 was a year of cautious optimism. Rate increases slowed to a crawl, and some companies reduced premiums. New laws gave homeowners better information about flood risks, more opportunities to strengthen roofs and windows, and more oversight of condo associations. Programs like My Safe Florida Condo promise to help owners of multi‑family buildings invest in safety. Yet challenges remain: premiums are still high, non‑renewals persist and the debate over attorney fees could return. Choosing the right contractor and staying proactive are essential.

At Orange Contracting and Roofing, we believe that knowledge is power. Understanding the laws and trends allows you to make smart decisions about your home. We’re committed to staying current on legislative changes and to providing quality workmanship that meets the latest building codes. If you’re thinking about a new roof or wind mitigation upgrade, contact us to schedule an inspection. Together, we can build a stronger, safer Florida.

Call Orange Contracting and Roofing at 407-205-2676 or email [email protected]

The company’s office is located at 105 Candace Dr., Suite 129, Maitland, FL 32751